Feeling overwhelmed by debt?

UK legislated programs are designed to help people in debt manage their finances. Some of their benefits include:

- A reduced monthly payment based on what the individual can afford. 💷

- Protection from legal action by creditors. ⚖️

- The ability to write off a portion of the debt. ✍️

- An end to creditor harassment and contact. 🚫📞

- A fixed, affordable payment plan. 📅

- Expert advice and support from a licensed Insolvency Practitioner (IP) throughout the process. 🧑⚖️📚

Feeling overwhelmed by debt?

UK legislated programs are designed to help people in debt manage their finances. Some of their benefits include:

- A reduced monthly payment based on what the individual can afford. 💷

- Protection from legal action by creditors. ⚖️

- The ability to write off a portion of the debt. ✍️

- An end to creditor harassment and contact. 🚫📞

- A fixed, affordable payment plan. 📅

- Expert advice and support from a licensed Insolvency Practitioner (IP) throughout the process. 🧑⚖️📚

At Expert Help UK, we understand the stress and anxiety that debt can cause, which is why we’re here to help. As one of the leading debt help companies in the UK, we offer a range of debt management solutions and services to help individuals and families struggling with debt. If you’re feeling overwhelmed by debt, you’ve come to the right place

Debts we can help you with

The Problem of Debt in the UK

Debt is a common issue in the UK, affecting millions of people from all walks of life. Many individuals and families struggle to manage their finances and make ends meet, often due to unexpected expenses, job loss, or illness. Falling into debt can happen to anyone, and it can be a source of immense stress and anxiety

Despite the widespread nature of debt in the UK, many people are reluctant to seek help or guidance. This is often due to feelings of shame or embarrassment, as well as a lack of understanding about the options available. However, it’s important to remember that seeking help is a sign of strength, not weakness.

At Expert Help UK, we understand the challenges of dealing with debt, and we’re here to help. Our team of experienced debt advisors can provide you with the support and guidance you need to take control of your finances and improve your financial outlook. Don’t let debt take over your life – contact us today to learn more about how we can help you find a way forward

How can we help you?

Answer a few questions

It only takes a few minutes, it’s totally free, and there’s no obligation.

Speak with an advisor

We will discuss the available options with you openly and honestly.

Pick a plan

Once the best solution for you is chosen we will guide you through the next stages.

By speaking to a debt advisor, you can get a better understanding of your financial situation and the options available to you. Debt advisors can offer you guidance on how to manage your debts, negotiate with creditors on your behalf, and help you develop a plan to become debt-free.

Don’t hesitate to reach out for free debt advice. It’s a great way to get started on the path to financial stability

Debt Solutions in the UK

If you’re struggling with debt, it can be overwhelming to know where to turn. Fortunately, there are several debt solutions available in the UK to help you manage your debt and improve your financial outlook. At Expert Help UK, our experienced debt advisors can help you understand the pros and cons of each solution and develop a plan that’s right for you

Some of the debt solutions available in the UK include

Debt Management Plans

A DMP is an informal agreement between you and creditors to repay your debts. With a debt management plan, you make one affordable monthly payment to a debt management company, which then distributes the payments to your creditors. DMPs can be a good option for those with unsecured debts, such as credit cards or personal loans

Debt Relief Orders

A debt relief order is a legal agreement that can help you write off your debts if you have little to no disposable income and few assets. Debt relief orders are intended for those with relatively low levels of debt and are a less severe option than bankruptcy

IVAs

An IVA is a formal agreement between you and your creditors to repay your debts over a set period, usually five to six years. With an IVA, you make one affordable monthly payment to an insolvency practitioner, who then distributes the payments to your creditors. At the end of the IVA period, any remaining debts are usually written off

At Expert Help UK, our team of experienced debt advisors can help you understand the pros and cons of each debt solution and develop a plan that’s right for you. We’ll work with you to understand your financial situation and develop a customized plan to help you manage your debt and improve your financial outlook

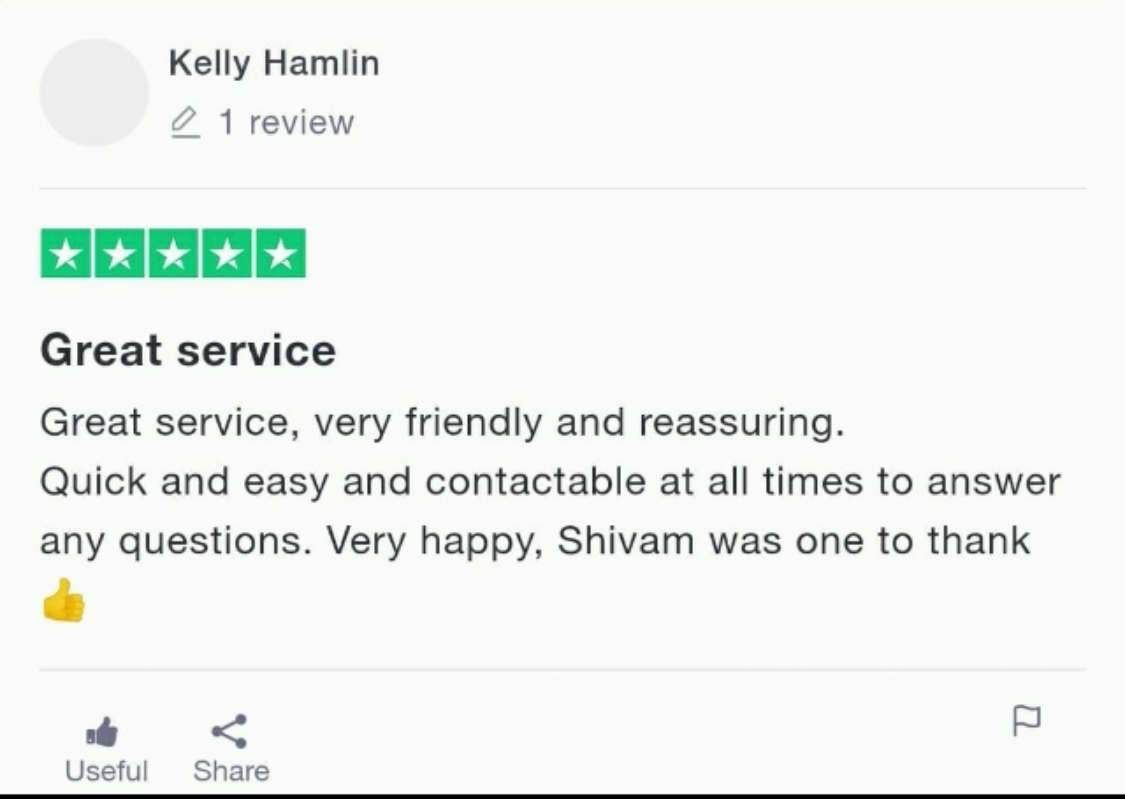

What our customers say

At Expert Help UK, we provide various services to assist individuals and families facing financial difficulties. Our knowledgeable debt advisors can guide you through your options and create a tailored plan for your needs. Here’s what our clients have to say

Money Helper is a free service set up by the Government to help people make the most of their money. visit www.moneyhelper.org.uk if you would like to learn more about Money Helper and their services.

At Expert Help UK, we understand the stress and anxiety that debt can cause. That’s why we offer a range of debt management solutions and services to help individuals and families struggling with debt. We’re committed to helping you take control of your finances and get back on track.

So don’t hesitate to contact us today. Fill out the form on our website to request a free debt assessment and consultation, or email us at info@uk-expert-help.co.uk. You can also visit our office located at Suite 6, Trafalgar House, 110 Manchester Road, ALTRINCHAM, WA14 1NU.

Our experienced debt advisors will work with you to understand your financial situation and develop a customized plan to help you manage your debt and improve your financial outlook.

Remember, there’s no obligation or pressure to proceed with a debt management plan after the consultation. If you choose to move forward with a plan, there is a fee associated with our services, but this fee is only applicable if you decide to proceed after the consultation.

Take the first step towards a debt-free future today. Contact Expert Help UK and know your options.